Bitcoin

| Bitcoin | |

|---|---|

Prevailing bitcoin logo | |

| Denominations | |

| Plural | bitcoins |

| Symbol | ₿ (Unicode: U+20BF ₿ BITCOIN SIGN (HTML ₿))[lower-alpha 1] |

| Ticker symbol | BTC, XBT[lower-alpha 2] |

| Precision | 10−8 |

| Subunits | |

| 1⁄1000 | millibitcoin |

| 1⁄100000000 | [2] |

| Development | |

| Original author(s) | Satoshi Nakamoto |

| White paper | "Bitcoin: A Peer-to-Peer Electronic Cash System" |

| Implementation(s) | Bitcoin Core |

| Initial release | 0.1.0 / 9 January 2009 |

| Latest release | 0.21.1 / 2 May 2021[3] |

| Code repository | https://github.com/bitcoin/bitcoin |

| Development status | Active |

| Website | bitcoin |

| Ledger | |

| Ledger start | 3 January 2009 |

| Timestamping scheme | Proof-of-work (partial hash inversion) |

| Hash function | SHA-256 |

| Issuance schedule | Decentralized (block reward) Initially ₿50 per block, halved every 210,000 blocks[6] |

| Block reward | ₿6.25[lower-alpha 3] |

| Block time | 10 minutes |

| Block explorer | Many implementations |

| Circulating supply | ₿18,660,000 (as of 20 March 2021[update]) |

| Supply limit | ₿21,000,000[4][lower-alpha 4] |

| |

Bitcoin (₿) is a decentralized digital currency, without a central bank or single administrator, that can be sent from user to user on the peer-to-peer bitcoin network without the need for intermediaries.[6] Transactions are verified by network nodes through cryptography and recorded in a public distributed ledger called a blockchain. The cryptocurrency was invented in 2008 by an unknown person or group of people using the name Satoshi Nakamoto.[7] The currency began use in 2009[8] when its implementation was released as open-source software.[5]:ch. 1

Bitcoins are created as a reward for a process known as mining. They can be exchanged for other currencies, products, and services,[9] but the real-world value of the coins is extremely volatile.[10] Research produced by the University of Cambridge estimated that in 2017, there were 2.9 to 5.8 million unique users using a cryptocurrency wallet, most of them using bitcoin.[11] Users choose to participate in the digital currency for a number of reasons: ideologies such as commitment to anarchism, decentralization and libertarianism, convenience, using the currency as an investment and pseudonymity of transactions. Increased use has led to a desire among governments for regulation in order to tax, facilitate legal use in trade and for other reasons (such as investigations for money laundering and price manipulation).

Bitcoin has been criticized for its use in illegal transactions, the large amount of electricity (and thus carbon footprint) used by mining, price volatility, and thefts from exchanges. Some economists and commentators have characterized it as a speculative bubble at various times. Bitcoin has also been used as an investment, although several regulatory agencies have issued investor alerts about bitcoin.[10][12][13]

The word bitcoin was defined in a white paper published on 31 October 2008.[14] It is a compound of the words bit and coin.[15] No uniform convention for bitcoin capitalization exists; some sources use Bitcoin, capitalized, to refer to the technology and network and bitcoin, lowercase, for the unit of account.[16] The Wall Street Journal,[17] The Chronicle of Higher Education,[18] and the Oxford English Dictionary[15] advocate the use of lowercase bitcoin in all cases.

History[edit | edit source]

Design[edit | edit source]

Bitcoin is based on an elliptic curve called "secp256k1" and encrypted with the ECDSA algorithm. The equation for the Bitcoin secp256k1 curve is 2=3+7.[19] Bitcoin has a proposed Bitcoin Improvement Proposal (BIP) that would add support for Schnorr signatures.[20]:101

Ideology[edit | edit source]

Satoshi Nakamoto stated in his white paper that: "The root problem with conventional currencies is all the trust that's required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust."[21]

Austrian economics roots[edit | edit source]

According to the European Central Bank, the decentralization of money offered by bitcoin has its theoretical roots in the Austrian school of economics, especially with Friedrich von Hayek in his book Denationalisation of Money: The Argument Refined,[22] in which Hayek advocates a complete free market in the production, distribution and management of money to end the monopoly of central banks.[23]:22

Anarchism and libertarianism[edit | edit source]

According to The New York Times, libertarians and anarchists were attracted to the philosophical idea behind bitcoin. Early bitcoin supporter Roger Ver said: "At first, almost everyone who got involved did so for philosophical reasons. We saw bitcoin as a great idea, as a way to separate money from the state."[21] The Economist describes bitcoin as "a techno-anarchist project to create an online version of cash, a way for people to transact without the possibility of interference from malicious governments or banks".[24] Economist Paul Krugman argues that cryptocurrencies like bitcoin are "something of a cult" based in "paranoid fantasies" of government power.[25]

Nigel Dodd argues in The Social Life of Bitcoin that the essence of the bitcoin ideology is to remove money from social, as well as governmental, control.[27] Dodd quotes a YouTube video, with Roger Ver, Jeff Berwick, Charlie Shrem, Andreas Antonopoulos, Gavin Wood, Trace Meyer and other proponents of bitcoin reading The Declaration of Bitcoin's Independence. The declaration includes a message of crypto-anarchism with the words: "Bitcoin is inherently anti-establishment, anti-system, and anti-state. Bitcoin undermines governments and disrupts institutions because bitcoin is fundamentally humanitarian."[27][26]

David Golumbia says that the ideas influencing bitcoin advocates emerge from right-wing extremist movements such as the Liberty Lobby and the John Birch Society and their anti-Central Bank rhetoric, or, more recently, Ron Paul and Tea Party-style libertarianism.[28] Steve Bannon, who owns a "good stake" in bitcoin, considers it to be "disruptive populism. It takes control back from central authorities. It's revolutionary."[29]

A 2014 study of Google Trends data found correlations between bitcoin-related searches and ones related to computer programming and illegal activity, but not libertarianism or investment topics.[30]

Economics[edit | edit source]

Bitcoin is a digital asset designed to work in peer-to-peer transactions as a currency.[31][32] Bitcoins have three qualities useful in a currency, according to The Economist in January 2015: they are "hard to earn, limited in supply and easy to verify."[33] Per some researchers, as of 2015[update], bitcoin functions more as a payment system than as a currency.

Economists define money as serving the following three purposes: a store of value, a medium of exchange, and a unit of account.[34] According to The Economist in 2014, bitcoin functions best as a medium of exchange.[34] However, this is debated, and a 2018 assessment by The Economist stated that cryptocurrencies met none of these three criteria.[24] Yale economist Robert J. Shiller writes that bitcoin has potential as a unit of account for measuring the relative value of goods, as with Chile's Unidad de Fomento, but that "Bitcoin in its present form [...] doesn't really solve any sensible economic problem".[35]

According to research by Cambridge University, between 2.9 million and 5.8 million unique users used a cryptocurrency wallet in 2017, most of them for bitcoin. The number of users has grown significantly since 2013, when there were 300,000–1.3 million users.[11]

Acceptance by merchants[edit | edit source]

The overwhelming majority of bitcoin transactions take place on a cryptocurrency exchange, rather than being used in transactions with merchants.[36] Delays processing payments through the blockchain of about ten minutes make bitcoin use very difficult in a retail setting. Prices are not usually quoted in units of bitcoin and many trades involve one, or sometimes two, conversions into conventional currencies. Merchants that do accept bitcoin payments may use payment service providers to perform the conversions.[37]

In 2017 and 2018 bitcoin's acceptance among major online retailers included only three of the top 500 U.S. online merchants, down from five in 2016.[36] Reasons for this decline include high transaction fees due to bitcoin's scalability issues and long transaction times.[38]

Bloomberg reported that the largest 17 crypto merchant-processing services handled $69 million in June 2018, down from $411 million in September 2017. Bitcoin is "not actually usable" for retail transactions because of high costs and the inability to process chargebacks, according to Nicholas Weaver, a researcher quoted by Bloomberg. High price volatility and transaction fees make paying for small retail purchases with bitcoin impractical, according to economist Kim Grauer. However, bitcoin continues to be used for large-item purchases on sites such as Overstock.com, and for cross-border payments to freelancers and other vendors.[39]

Financial institutions[edit | edit source]

Bitcoins can be bought on digital currency exchanges.

Per researchers, "there is little sign of bitcoin use" in international remittances despite high fees charged by banks and Western Union who compete in this market. The South China Morning Post, however, mentions the use of bitcoin by Hong Kong workers to transfer money home.[40]

In 2014, the National Australia Bank closed accounts of businesses with ties to bitcoin,[41] and HSBC refused to serve a hedge fund with links to bitcoin.[42] Australian banks in general have been reported as closing down bank accounts of operators of businesses involving the currency.[43]

On 10 December 2017, the Chicago Board Options Exchange started trading bitcoin futures,[44] followed by the Chicago Mercantile Exchange, which started trading bitcoin futures on 17 December 2017.[45]

In September 2019 the Central Bank of Venezuela, at the request of PDVSA, ran tests to determine if bitcoin and ether could be held in central bank's reserves. The request was motivated by oil company's goal to pay its suppliers.[46]

As an investment[edit | edit source]

The Winklevoss twins have purchased bitcoin. In 2013, The Washington Post reported a claim that they owned 1% of all the bitcoins in existence at the time.[47]

Other methods of investment are bitcoin funds. The first regulated bitcoin fund was established in Jersey in July 2014 and approved by the Jersey Financial Services Commission.[48]

Forbes named bitcoin the best investment of 2013.[49] In 2014, Bloomberg named bitcoin one of its worst investments of the year.[50] In 2015, bitcoin topped Bloomberg's currency tables.[51]

According to bitinfocharts.com, in 2017 there are 9,272 bitcoin wallets with more than $1 million worth of bitcoins.[52] The exact number of bitcoin millionaires is uncertain as a single person can have more than one bitcoin wallet.

In August 2020, MicroStrategy invested in Bitcoin.[53][54]

In May 2021, the Bitcoin's market share on exchanges dropped from 70% to 45% as investors pursued altcoins.[55]

Venture capital[edit | edit source]

Peter Thiel's Founders Fund invested US$3 million in BitPay.[56] In 2012, an incubator for bitcoin-focused start-ups was founded by Adam Draper, with financing help from his father, venture capitalist Tim Draper, one of the largest bitcoin holders after winning an auction of 30,000 bitcoins,[57] at the time called "mystery buyer".[58] The company's goal is to fund 100 bitcoin businesses within 2–3 years with $10,000 to $20,000 for a 6% stake.[57] Investors also invest in bitcoin mining.[59] According to a 2015 study by Paolo Tasca, bitcoin startups raised almost $1 billion in three years (Q1 2012 – Q1 2015).[60]

Price and volatility[edit | edit source]

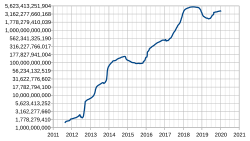

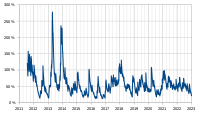

The price of bitcoins has gone through cycles of appreciation and depreciation referred to by some as bubbles and busts.[61] In 2011, the value of one bitcoin rapidly rose from about US$0.30 to US$32 before returning to US$2.[62] In the latter half of 2012 and during the 2012–13 Cypriot financial crisis, the bitcoin price began to rise,[63] reaching a high of US$266 on 10 April 2013, before crashing to around US$50. On 29 November 2013, the cost of one bitcoin rose to a peak of US$1,242.[64] In 2014, the price fell sharply, and as of April remained depressed at little more than half 2013 prices. As of August 2014[update] it was under US$600.[65]

According to Mark T. Williams, as of 30 September 2014[update], bitcoin has volatility seven times greater than gold, eight times greater than the S&P 500, and 18 times greater than the US dollar.[66] Hodl is a meme created in reference to holding (as opposed to selling) during periods of volatility. Unusual for an asset, bitcoin weekend trading during December 2020 was higher than for weekdays.[67] Hedge funds (using high leverage and derivates)[68] have attempted to use the volatility to profit from downward price movements. At the end of January 2021, such positions were over $1 billion, their highest of all time.[69][70] As of 8 February 2021[update], the closing price of bitcoin equals US$44,797.[71]

Legal status, tax and regulation[edit | edit source]

Because of bitcoin's decentralized nature and its trading on online exchanges located in many countries, regulation of bitcoin has been difficult. However, the use of bitcoin can be criminalized, and shutting down exchanges and the peer-to-peer economy in a given country would constitute a de facto ban.[72] The legal status of bitcoin varies substantially from country to country and is still undefined or changing in many of them. Regulations and bans that apply to bitcoin probably extend to similar cryptocurrency systems.[60]

According to the Library of Congress, an "absolute ban" on trading or using cryptocurrencies applies in nine countries: Algeria, Bolivia, Egypt, Iraq, Morocco, Nepal, Pakistan, Vietnam, and the United Arab Emirates. An "implicit ban" applies in another 15 countries, which include Bahrain, Bangladesh, China, Colombia, the Dominican Republic, Indonesia, Kuwait, Lesotho, Lithuania, Macau, Oman, Qatar, Saudi Arabia and Taiwan.[73]

In October 2020, the Islamic Republic News Agency announced pending regulations that would require bitcoin miners in Iran to sell bitcoin to the Central Bank of Iran, and the central bank would use it for imports.[74] Iran, as of October 2020, had issued over 1,000 bitcoin mining licenses.[74] The Iranian government initially took a stance against cryptocurrency, but later changed it after seeing that digital currency could be used to circumvent sanctions.[75] The US Office of Foreign Assets Control listed two Iranians and their bitcoin addresses as part of its Specially Designated Nationals and Blocked Persons List for their role in the 2018 Atlanta cyberattack whose ransom was paid in bitcoin.[76]

Regulatory warnings[edit | edit source]

The U.S. Commodity Futures Trading Commission has issued four "Customer Advisories" for bitcoin and related investments.[12] A July 2018 warning emphasized that trading in any cryptocurrency is often speculative, and there is a risk of theft from hacking, and fraud.[77] In May 2014 the U.S. Securities and Exchange Commission warned that investments involving bitcoin might have high rates of fraud, and that investors might be solicited on social media sites.[78] An earlier "Investor Alert" warned about the use of bitcoin in Ponzi schemes.[79]

The European Banking Authority issued a warning in 2013 focusing on the lack of regulation of bitcoin, the chance that exchanges would be hacked, the volatility of bitcoin's price, and general fraud.[80] FINRA and the North American Securities Administrators Association have both issued investor alerts about bitcoin.[81][82]

Price manipulation investigation[edit | edit source]

An official investigation into bitcoin traders was reported in May 2018.[83] The U.S. Justice Department launched an investigation into possible price manipulation, including the techniques of spoofing and wash trades.[84][85][86]

The U.S. federal investigation was prompted by concerns of possible manipulation during futures settlement dates. The final settlement price of CME bitcoin futures is determined by prices on four exchanges, Bitstamp, Coinbase, itBit and Kraken. Following the first delivery date in January 2018, the CME requested extensive detailed trading information but several of the exchanges refused to provide it and later provided only limited data. The Commodity Futures Trading Commission then subpoenaed the data from the exchanges.[87][88]

State and provincial securities regulators, coordinated through the North American Securities Administrators Association, are investigating "bitcoin scams" and ICOs in 40 jurisdictions.[89]

Academic research published in the Journal of Monetary Economics concluded that price manipulation occurred during the Mt Gox bitcoin theft and that the market remains vulnerable to manipulation.[90] The history of hacks, fraud and theft involving bitcoin dates back to at least 2011.[91]

Research by John M. Griffin and Amin Shams in 2018 suggests that trading associated with increases in the amount of the Tether cryptocurrency and associated trading at the Bitfinex exchange account for about half of the price increase in bitcoin in late 2017.[92][93]

J.L. van der Velde, CEO of both Bitfinex and Tether, denied the claims of price manipulation: "Bitfinex nor Tether is, or has ever, engaged in any sort of market or price manipulation. Tether issuances cannot be used to prop up the price of bitcoin or any other coin/token on Bitfinex."[94]

Analysis[edit | edit source]

The Bank for International Settlements summarized several criticisms of bitcoin in Chapter V of their 2018 annual report. The criticisms include the lack of stability in bitcoin's price, the high energy consumption, high and variable transactions costs, the poor security and fraud at cryptocurrency exchanges, vulnerability to debasement (from forking), and the influence of miners.[95][96][97]

François R. Velde, Senior Economist at the Chicago Fed, described bitcoin as "an elegant solution to the problem of creating a digital currency".[98] David Andolfatto, Vice President at the Federal Reserve Bank of St. Louis, stated that bitcoin is a threat to the establishment, which he argues is a good thing for the Federal Reserve System and other central banks, because it prompts these institutions to operate sound policies.:33[99][100]

Economic concerns[edit | edit source]

Bitcoin, along with other cryptocurrencies, has been described as an economic bubble by at least eight Nobel Memorial Prize in Economic Sciences laureates at various times, including Robert Shiller on 1 March 2014,[35] Joseph Stiglitz on 29 November 2017,[101] and Richard Thaler on 21 December 2017.[102][103] On 29 January 2018, a noted Keynesian economist Paul Krugman has described bitcoin as "a bubble wrapped in techno-mysticism inside a cocoon of libertarian ideology",[25] on 2 February 2018, professor Nouriel Roubini of New York University has called bitcoin the "mother of all bubbles",[104] and on 27 April 2018, a University of Chicago economist James Heckman has compared it to the 17th-century tulip mania.[103]

Journalists, economists, investors, and the central bank of Estonia have voiced concerns that bitcoin is a Ponzi scheme.[105][106][107][108] In April 2013, Eric Posner, a law professor at the University of Chicago, stated that "a real Ponzi scheme takes fraud; bitcoin, by contrast, seems more like a collective delusion."[109] A July 2014 report by the World Bank concluded that bitcoin was not a deliberate Ponzi scheme.[110]:7 In June 2014, the Swiss Federal Council examined concerns that bitcoin might be a pyramid scheme, and concluded that "since in the case of bitcoin the typical promises of profits are lacking, it cannot be assumed that bitcoin is a pyramid scheme."[111]:21

Energy consumption and carbon footprint[edit | edit source]

Bitcoin has been criticized for the amount of electricity consumed by mining.

As of 2015[update], estimated combined electricity consumption attributed to mining was 166.7 megawatts and by 2017, was estimated to be between one and four gigawatts of electricity.[112][33] In 2018, bitcoin was estimated by to use 2.55 to 3.572 GW, or around 6% of the total power consumed by the global banking sector.[113][114][115] In July 2019 BBC reported bitcoin consumes about 7 gigawatts, 0.2% of the global total, or equivalent to that of Switzerland.[116] A 2021 estimate from the University of Cambridge suggests bitcoin consumes more than 178 (TWh) annually, ranking it in the top 30 energy consumers if it were a country.[117]

Bitcoin is mined in places like Iceland where geothermal energy is cheap and cooling Arctic air is free.[118] Bitcoin miners are known to use hydroelectric power in Tibet, Quebec, Washington (state), and Austria to reduce electricity costs.[113][119] Miners are attracted to suppliers such as Hydro Quebec that have energy surpluses.[120]

According to a University of Cambridge study, much of bitcoin mining is done in China, where electricity is subsidized by the government.[121][122] A significant part of Bitcoin mining is powered by cheap electricity in Xinjiang, which mostly comes from coal power.[123][124] In April 2021 a coal mine explosion in the province coincided with a 35% drop in hashing power and a flash crash in price.[125][123] In other provinces, such as Hunan and Sichuan, mining farms use more hydropower, however these account for at most 4% of hash power. According to Alex de Vries, renewable energy is not a good match for Bitcoin mining as 24/7 operations are best for ROI on mining devices.[125] In 2021, a US company purchased the Greenidge coal power plant and converted it to burn natural gas for the sole purpose of mining bitcoin, which has proven to be highly profitable, in spite of protests of local residents against air pollution and thermal pollution.[126]

Concerns about bitcoin's environmental impact relate bitcoin's energy consumption to carbon emissions.[127][128] The difficulty of translating the energy consumption into carbon emissions lies in the decentralized nature of bitcoin impeding the localization of miners to examine the electricity mix used. The results of recent studies analyzing bitcoin's carbon footprint vary.[129][130][131][132] A study published in Nature Climate Change in 2018 claims that bitcoin "could alone produce enough CO

2 emissions to push warming above 2 °C within less than three decades."[131] However, other researchers criticized this analysis, arguing the underlying scenarios were inadequate, leading to overestimations.[133][134][135] According to studies published in Joule and American Chemical Society in 2019, bitcoin's annual energy consumption results in annual carbon emission ranging from 17[115] to 22.9 MtCO

2 which is comparable to the level of emissions of countries as Jordan and Sri Lanka or Kansas City.[132] George Kamiya, writing for the International Energy Agency, says that "predictions about bitcoin consuming the entire world's electricity" are sensational, but that the area "requires careful monitoring and rigorous analysis".[136]

Use in illegal transactions[edit | edit source]

Bitcoin held at exchanges are vulnerable to theft through phishing, scamming, and hacking. As of December 2017[update], around 980,000 bitcoins have been stolen from cryptocurrency exchanges.

The use of bitcoin by criminals has attracted the attention of financial regulators, legislative bodies, law enforcement, and the media.[137] Bitcoin gained early notoriety for its use on the Silk Road. The U.S. Senate held a hearing on virtual currencies in November 2013.[138] The U.S. government claimed that bitcoin was used to facilitate payments related to Russian interference in the 2016 United States elections.[139] However, a 2021 study led by former CIA director Michael Morell showed that broad generalizations about the use of bitcoin in illicit finance are significantly overstated and that blockchain analysis is an effective crime fighting and intelligence gathering tool.[140]

Several news outlets have asserted that the popularity of bitcoins hinges on the ability to use them to purchase illegal goods.[32][141] Nobel-prize winning economist Joseph Stiglitz says that bitcoin's anonymity encourages money laundering and other crimes.[142][143]

In 2014, researchers at the University of Kentucky found "robust evidence that computer programming enthusiasts and illegal activity drive interest in bitcoin, and find limited or no support for political and investment motives".[30] Australian researchers have estimated that 25% of all bitcoin users and 44% of all bitcoin transactions are associated with illegal activity as of April 2017[update]. There were an estimated 24 million bitcoin users primarily using bitcoin for illegal activity. They held $8 billion worth of bitcoin, and made 36 million transactions valued at $72 billion.[144][145]

Software implementation[edit | edit source]

The start screen under Fedora | |

| Original author(s) | Satoshi Nakamoto |

|---|---|

| Initial release | 2009 |

| Written in | C++ |

| Operating system | Linux, Windows, macOS |

| Type | Cryptocurrency |

| License | MIT License |

| Website | bitcoincore |

Bitcoin Core is free and open-source software that serves as a bitcoin node (the set of which form the bitcoin network) and provides a bitcoin wallet which fully verifies payments. It is considered to be bitcoin's reference implementation.[146] Initially, the software was published by Satoshi Nakamoto under the name "Bitcoin", and later renamed to "Bitcoin Core" to distinguish it from the network.[147] It is also known as the Satoshi client.[148]

The MIT Digital Currency Initiative funds some of the development of Bitcoin Core.[149] The project also maintains the cryptography library libsecp256k1.[150]

Bitcoin Core includes a transaction verification engine and connects to the bitcoin network as a full node.[148] Moreover, a cryptocurrency wallet, which can be used to transfer funds, is included by default.[150] The wallet allows for the sending and receiving of bitcoins. It does not facilitate the buying or selling of bitcoin. It allows users to generate QR codes to receive payment.

The software validates the entire blockchain, which includes all bitcoin transactions ever. This distributed ledger which has reached more than 235 gigabytes in size as of Jan 2019, must be downloaded or synchronized before full participation of the client may occur.[148] Although the complete blockchain is not needed all at once since it is possible to run in pruning mode. A command line-based daemon with a JSON-RPC interface, bitcoind, is bundled with Bitcoin Core. It also provides access to testnet, a global testing environment that imitates the bitcoin main network using an alternative blockchain where valueless "test bitcoins" are used. Regtest or Regression Test Mode creates a private blockchain which is used as a local testing environment.[151] Finally, bitcoin-cli, a simple program which allows users to send RPC commands to bitcoind, is also included.

Checkpoints which have been hard coded into the client are used only to prevent Denial of Service attacks against nodes which are initially syncing the chain. For this reason the checkpoints included are only as of several years ago.[152][153][failed verification] A one megabyte block size limit was added in 2010 by Satoshi Nakamoto. This limited the maximum network capacity to about three transactions per second.[154] Since then, network capacity has been improved incrementally both through block size increases and improved wallet behavior. A network alert system was included by Satoshi Nakamoto as a way of informing users of important news regarding bitcoin.[155] In November 2016 it was retired. It had become obsolete as news on bitcoin is now widely disseminated.

Bitcoin Core includes a scripting language inspired by Forth that can define transactions and specify parameters.[156] ScriptPubKey is used to "lock" transactions based on a set of future conditions. scriptSig is used to meet these conditions or "unlock" a transaction. Operations on the data are performed by various OP_Codes. Two stacks are used - main and alt. Looping is forbidden.

Bitcoin Core uses OpenTimestamps to timestamp merge commits.[157]

The original creator of the bitcoin client has described their approach to the software's authorship as it being written first to prove to themselves that the concept of purely peer-to-peer electronic cash was valid and that a paper with solutions could be written. The lead developer is Wladimir J. van der Laan, who took over the role on 8 April 2014.[158] Gavin Andresen was the former lead maintainer for the software client. Andresen left the role of lead developer for bitcoin to work on the strategic development of its technology.[158] Bitcoin Core in 2015 was central to a dispute with Bitcoin XT, a competing client that sought to increase the blocksize.[159] Over a dozen different companies and industry groups fund the development of Bitcoin Core.

In popular culture[edit | edit source]

Term "HODL"[edit | edit source]

Hodl (/ˈhɒdəl/ HOD-əl; often written HODL) is slang in the cryptocurrency community for holding a cryptocurrency rather than selling it.[160] A person who does this is known as a Hodler. It originated in a December 2013 post on the Bitcoin Forum message board by an apparently inebriated user who posted with a typo in the subject, "I AM HODLING."[161] It is often humorously suggested to be a backronym to "hold on for dear life".[162] In 2017, Quartz listed it as one of the essential slang terms in Bitcoin culture, and described it as a stance, "to stay invested in bitcoin and not to capitulate in the face of plunging prices."[163] TheStreet.com referred to it as the "favorite mantra" of Bitcoin holders.[164] Bloomberg News referred to it as a "mantra" for holders during market routs.[165]

Literature[edit | edit source]

In Charles Stross' 2013 science fiction novel, Neptune's Brood, the universal interstellar payment system is known as "bitcoin" and operates using cryptography.[166] Stross later blogged that the reference was intentional, saying "I wrote Neptune's Brood in 2011. Bitcoin was obscure back then, and I figured had just enough name recognition to be a useful term for an interstellar currency: it'd clue people in that it was a networked digital currency."[167]

Film[edit | edit source]

The 2014 documentary The Rise and Rise of Bitcoin portrays the diversity of motives behind the use of bitcoin by interviewing people who use it. These include a computer programmer and a drug dealer.[168] The 2016 documentary Banking on Bitcoin is an introduction to the beginnings of bitcoin and the ideas behind cryptocurrency today.[169]

Academia[edit | edit source]

In September 2015, the establishment of the peer-reviewed academic journal Ledger (ISSN 2379-5980) was announced. It covers studies of cryptocurrencies and related technologies, and is published by the University of Pittsburgh.[170] The journal encourages authors to digitally sign a file hash of submitted papers, which will then be timestamped into the bitcoin blockchain. Authors are also asked to include a personal bitcoin address in the first page of their papers.[171][172]

See also[edit | edit source]

Notes[edit | edit source]

- ↑ Liquidity is estimated by a 365-day running sum of transaction outputs in USD.

References[edit | edit source]

- ↑ "Unicode 10.0.0". Unicode Consortium. 20 June 2017. Archived from the original on 20 June 2017. Retrieved 20 June 2017.

- ↑ Mick, Jason (12 June 2011). "Cracking the Bitcoin: Digging Into a $131M USD Virtual Currency". Daily Tech. Archived from the original on 20 January 2013. Retrieved 30 September 2012.

- ↑ "Releases - bitcoin/bitcoin". Retrieved 9 May 2021 – via GitHub.

- ↑ Nakamoto; et al. (1 April 2016). "Bitcoin source code - amount constraints". Archived from the original on 1 July 2018.

- ↑ 5.0 5.1 Antonopoulos, Andreas M. (April 2014). Mastering Bitcoin: Unlocking Digital Crypto-Currencies. O'Reilly Media. ISBN 978-1-4493-7404-4.

- ↑ 6.0 6.1 "Statement of Jennifer Shasky Calvery, Director Financial Crimes Enforcement Network United States Department of the Treasury Before the United States Senate Committee on Banking, Housing, and Urban Affairs Subcommittee on National Security and International Trade and Finance Subcommittee on Economic Policy" (PDF). fincen.gov. Financial Crimes Enforcement Network. 19 November 2013. Archived (PDF) from the original on 9 October 2016. Retrieved 1 June 2014.

- ↑ S., L. (2 November 2015). "Who is Satoshi Nakamoto?". The Economist. The Economist Newspaper Limited. Archived from the original on 21 August 2016. Retrieved 23 September 2016.

- ↑ Davis, Joshua (10 October 2011). "The Crypto-Currency: Bitcoin and its mysterious inventor". The New Yorker. Archived from the original on 1 November 2014. Retrieved 31 October 2014.

- ↑ "What is Bitcoin?". CNN Money. Archived from the original on 31 October 2015. Retrieved 16 November 2015.

- ↑ 10.0 10.1 GmbH, finanzen net. "Bitcoin's limited real-world use and extreme volatility show its recent surge is still a speculative bubble, UBS Global Wealth Management says". markets.businessinsider.com. Retrieved 28 March 2021.

- ↑ 11.0 11.1 Hileman, Garrick; Rauchs, Michel. "Global Cryptocurrency Benchmarking Study" (PDF). Cambridge University. Archived (PDF) from the original on 10 April 2017. Retrieved 14 April 2017.

- ↑ 12.0 12.1 "Bitcoin". U.S. Commodity Futures Trading Commission. Archived from the original on 1 July 2018. Retrieved 17 July 2018.

- ↑ "SEC.gov | INVESTOR ALERT: BITCOIN AND OTHER VIRTUAL CURRENCY-RELATED INVESTMENTS". www.sec.gov. Archived from the original on 3 June 2019. Retrieved 1 June 2019.

- ↑ Vigna, Paul; Casey, Michael J. (January 2015). The Age of Cryptocurrency: How Bitcoin and Digital Money Are Challenging the Global Economic Order (1 ed.). New York: St. Martin's Press. ISBN 978-1-250-06563-6.

- ↑ 15.0 15.1 "bitcoin". OxfordDictionaries.com. Archived from the original on 2 January 2015. Retrieved 28 December 2014.

- ↑ Bustillos, Maria (2 April 2013). "The Bitcoin Boom". The New Yorker. Condé Nast. Archived from the original on 27 July 2014. Retrieved 22 December 2013.

Standards vary, but there seems to be a consensus forming around Bitcoin, capitalized, for the system, the software, and the network it runs on, and bitcoin, lowercase, for the currency itself.

- ↑ Vigna, Paul (3 March 2014). "BitBeat: Is It Bitcoin, or bitcoin? The Orthography of the Cryptography". WSJ. Archived from the original on 19 April 2014. Retrieved 21 April 2014.

- ↑ Metcalf, Allan (14 April 2014). "The latest style". Lingua Franca blog. The Chronicle of Higher Education (chronicle.com). Archived from the original on 16 April 2014. Retrieved 19 April 2014.

- ↑ Houria, Azine; Mohamed Abdelkader, Bencherif; Abderezzak, Guessoum (1 March 2019). "A comparison between the secp256r1 and the koblitz secp256k1 bitcoin curves". Indonesian Journal of Electrical Engineering and Computer Science. 13 (3): 910. doi:10.11591/ijeecs.v13.i3.pp910-918.

- ↑ Van Hijfte, Stijn (2020). Blockchain Platforms: A Look at the Underbelly of Distributed Platforms. Morgan & Claypool Publishers. ISBN 9781681738925.

- ↑ 21.0 21.1 Feuer, Alan (14 December 2013). "The Bitcoin Ideology". The New York Times. Archived from the original on 1 July 2018. Retrieved 1 July 2018.

- ↑ Friedrich von Hayek (October 1976). Denationalisation of Money: The Argument Refined. 2 Lord North Street, Westminster, London SWIP 3LB: The institute of economic affairs. ISBN 978-0-255-36239-9. Archived from the original on 11 January 2020. Retrieved 10 September 2015.

{{cite book}}: CS1 maint: location (link) - ↑ European Central Bank (October 2012). Virtual Currency Schemes (PDF). Frankfurt am Main: European Central Bank. ISBN 978-92-899-0862-7. Archived (PDF) from the original on 6 November 2012.

- ↑ 24.0 24.1 "Bitcoin and other cryptocurrencies are useless". The Economist. 30 August 2018. Archived from the original on 4 September 2018. Retrieved 4 September 2018.

Lack of adoption and loads of volatility mean that cryptocurrencies satisfy none of those criteria.

- ↑ 25.0 25.1 Krugman, Paul (29 January 2018). "Bubble, Bubble, Fraud and Trouble". The New York Times. Archived from the original on 4 June 2018.

- ↑ 26.0 26.1 Tourianski, Julia (13 August 2014). "The Declaration Of Bitcoin's Independence". Archive.org. Archived from the original on 23 March 2019. Retrieved 1 July 2018.

- ↑ 27.0 27.1 Dodd, Nigel (2017). "The social life of Bitcoin" (PDF). LSE Research Online. Archived (PDF) from the original on 1 July 2018. Retrieved 1 July 2018.

- ↑ Golumbia, David (2015). Lovink, Geert (ed.). Bitcoin as Politics: Distributed Right-Wing Extremism. Institute of Network Cultures, Amsterdam. pp. 117–131. ISBN 978-90-822345-5-8. SSRN 2589890.

- ↑ Peters, Jeremy W.; Popper, Nathaniel (14 June 2018). "Stephen Bannon Buys Into Bitcoin". The New York Times. Archived from the original on 1 July 2018. Retrieved 1 July 2018.

- ↑ 30.0 30.1 Matthew Graham Wilson & Aaron Yelowitz (November 2014). "Characteristics of Bitcoin Users: An Analysis of Google Search Data". Social Science Research Network. Working Papers Series. SSRN 2518603.

- ↑ Cite error: Invalid

<ref>tag; no text was provided for refs namedpaper - ↑ 32.0 32.1 "Monetarists Anonymous". The Economist. The Economist Newspaper Limited. 29 September 2012. Archived from the original on 20 October 2013. Retrieved 21 October 2013.

- ↑ 33.0 33.1 "The magic of mining". The Economist. 13 January 2015. Archived from the original on 12 January 2015. Retrieved 13 January 2015.

- ↑ 34.0 34.1 "Free Exchange. Money from nothing. Chronic deflation may keep Bitcoin from displacing its rivals". The Economist. 15 March 2014. Archived from the original on 25 March 2014. Retrieved 25 March 2014.

- ↑ 35.0 35.1 Shiller, Robert (1 March 2014). "In Search of a Stable Electronic Currency". The New York Times. Archived from the original on 24 October 2014.

- ↑ 36.0 36.1 Murphy, Hannah (8 June 2018). "Who really owns bitcoin now?". Financial Times. Archived from the original on 10 June 2018. Retrieved 10 June 2018.

- ↑ Karkaria, Urvaksh (23 September 2014). "Atlanta-based BitPay hooks up with PayPal to expand bitcoin adoption". Atlanta Business Chronicle. Archived from the original on 26 October 2014.

- ↑ Katz, Lily (12 July 2017). "Bitcoin Acceptance Among Retailers Is Low and Getting Lower". Bloomberg. Archived from the original on 25 January 2018. Retrieved 25 January 2018.

- ↑ Kharif, Olga (1 August 2018). "Bitcoin's Use in Commerce Keeps Falling Even as Volatility Eases". Bloomberg. Archived from the original on 2 August 2018. Retrieved 2 August 2018.

- ↑ Chan, Bernice (16 January 2015). "Bitcoin transactions cut the cost of international money transfers". South China Morning Post. Archived from the original on 31 May 2019. Retrieved 31 May 2019.

- ↑ "Bitcoin firms dumped by National Australia Bank as 'too risky'". The Guardian. Australian Associated Press. 10 April 2014. Archived from the original on 23 February 2015. Retrieved 23 February 2015.

- ↑ Weir, Mike (1 December 2014). "HSBC severs links with firm behind Bitcoin fund". bbc.com. BBC. Archived from the original on 3 February 2015. Retrieved 9 January 2015.

- ↑ "ACCC investigating why banks are closing bitcoin companies' accounts". Financial Review. 19 October 2015. Archived from the original on 11 February 2016. Retrieved 28 January 2016.

- ↑ "Bitcoin futures surge in first day of trading". CBS News. 11 December 2017. Archived from the original on 31 May 2019. Retrieved 31 May 2019.

- ↑ "Chicago Mercantile Exchange jumps into bitcoin futures". CBS News. 18 December 2017. Archived from the original on 31 May 2019. Retrieved 31 May 2019.

- ↑ "Venezuela Has Bitcoin Stash and Doesn't Know What to Do With It". Bloomberg. 26 September 2019. Archived from the original on 26 September 2019. Retrieved 26 September 2019.

- ↑ Lee, Timothy B. "The $11 million in bitcoins the Winklevoss brothers bought is now worth $32 million". The Switch. The Washington Post. Archived from the original on 6 July 2017. Retrieved 11 August 2017.

- ↑ "Jersey approve Bitcoin fund launch on island". BBC news. 10 July 2014. Archived from the original on 10 July 2014. Retrieved 10 July 2014.

- ↑ Hill, Kashmir. "How You Should Have Spent $100 In 2013 (Hint: Bitcoin)". Forbes. Archived from the original on 19 February 2015. Retrieved 16 February 2015.

- ↑ Steverman, Ben (23 December 2014). "The Best and Worst Investments of 2014". bloomberg.com. Bloomberg LP. Archived from the original on 9 January 2015. Retrieved 9 January 2015.

- ↑ Gilbert, Mark (29 December 2015). "Bitcoin Won 2015. Apple ... Did Not". Bloomberg. Archived from the original on 29 December 2015. Retrieved 29 December 2015.

- ↑ "Top 100 Richest Bitcoin Addresses and Bitcoin distribution". bitinfocharts.com. Archived from the original on 15 October 2017. Retrieved 14 October 2017.

- ↑ "MicroStrategy Buys $50 Million Worth Of Bitcoin, Topping Up Holdings To $766M". 5 December 2020.

- ↑ "MicroStrategy buys $250M in Bitcoin as CEO says it's superior to cash". Washington Business Journal. 11 August 2020. Retrieved 11 August 2020.

- ↑ Wilson, Tom (18 May 2021). "Buyers beware as "altcoin" frenzy bruises bitcoin". Reuters. Retrieved 19 May 2021.

- ↑ Simonite, Tom (12 June 2013). "Bitcoin Millionaires Become Investing Angels". Computing News. MIT Technology Review. Retrieved 13 June 2013.

- ↑ 57.0 57.1 Robin Sidel (1 December 2014). "Ten-hut! Bitcoin Recruits Snap To". The Wall Street Journal. Dow Jones & Company. Retrieved 9 December 2014. [dead link]

- ↑ Alex Hern (1 July 2014). "Silk Road's legacy 30,000 bitcoin sold at auction to mystery buyers". The Guardian. Archived from the original on 23 October 2014. Retrieved 31 October 2014.

- ↑ "CoinSeed raises $7.5m, invests $5m in Bitcoin mining hardware – Investment Round Up". Red Herring. 24 January 2014. Archived from the original on 9 March 2014. Retrieved 9 March 2014.

- ↑ 60.0 60.1 Tasca, Paolo (7 September 2015), Digital Currencies: Principles, Trends, Opportunities, and Risks, Social Science Research Network, SSRN 2657598

- ↑ Moore, Heidi (3 April 2013). "Confused about Bitcoin? It's 'the Harlem Shake of currency'". The Guardian. Archived from the original on 1 March 2014. Retrieved 2 May 2014.

- ↑ Lee, Timothy (5 November 2013). "When will the people who called Bitcoin a bubble admit they were wrong". The Washington Post. Archived from the original on 11 January 2014. Retrieved 10 January 2014.

- ↑ Liu, Alec (19 March 2013). "When Governments Take Your Money, Bitcoin Looks Really Good". Motherboard. Archived from the original on 7 February 2014. Retrieved 7 January 2014.

- ↑ Ben Rooney (29 November 2013). "Bitcoin worth almost as much as gold". CNN. Archived from the original on 26 October 2014. Retrieved 31 October 2014.

- ↑ "Bitcoin prices remain below $600 amid bearish chart signals". nasdaq.com. August 2014. Archived from the original on 14 October 2014. Retrieved 31 October 2014..

- ↑ Williams, Mark T. (21 October 2014). "Virtual Currencies – Bitcoin Risk" (PDF). World Bank Conference Washington DC. Boston University. Archived (PDF) from the original on 11 November 2014. Retrieved 11 November 2014.

- ↑ Irrera, Tom Wilson, Anna (11 January 2021). "Analysis: Cancel your weekends! Bitcoin doesn't rest, and neither can you". Reuters. Archived from the original on 6 February 2021.

Trading volumes across six major cryptocurrency exchanges have been 10% higher at weekends than weekdays in that period

{{cite web}}: CS1 maint: multiple names: authors list (link) - ↑ Zaki, Myret (14 January 2021). "Bitcoin: The Derivative Bomb". The Market (in Deutsch). Archived from the original on 15 January 2021.

the lion's share of institutional trading in bitcoin is being done without owning any single bitcoin. The bitcoin derivative boom was encouraged by the fact that you can get 2 to 3 times leverage on the CME, and more than 100 x leverage on native crypto derivative exchanges. In 2020, the ratio between bitcoin futures and spot volumes has increased from 2,3 to 4,6 in 2019

- ↑ Bambrough, Billy (30 January 2021). "Data Reveals Bitcoin Could Be About To Become The New GameStop After Huge Price Spike". Forbes. Archived from the original on 9 February 2021. Retrieved 9 February 2021.

The net short position in bitcoin futures is now the biggest it has ever been, according to the CFTC's latest Traders in Financial Futures report. .. hedge funds increasingly bet against the bitcoin price

- ↑ "CFTC Commitments of Traders Short Report - Financial Traders in Markets (Futures Only)". cftc.gov. Commodity Futures Trading Commission (CFTC). 2–5 February 2021. Archived from the original on 8 February 2021.

BITCOIN - CHICAGO MERCANTILE EXCHANGE, CFTC Code #133741

- ↑ "WSJ Markets Bitcoin USD". Retrieved 8 February 2021.

- ↑ "China May Be Gearing Up to Ban Bitcoin". pastemagazine.com. 18 September 2017. Archived from the original on 3 October 2017. Retrieved 6 October 2017.

The decentralized nature of bitcoin is such that it is impossible to "ban" the cryptocurrency, but if you shut down exchanges and the peer-to-peer economy running on bitcoin, it's a de facto ban.

- ↑ "Regulation of Cryptocurrency Around the World" (PDF). Library of Congress. The Law Library of Congress, Global Legal Research Center. June 2018. pp. 4–5. Archived (PDF) from the original on 14 August 2018. Retrieved 15 August 2018.

- ↑ 74.0 74.1 "Iran: New Crypto Law Requires Selling Bitcoin Directly to Central Bank to Fund Imports". aawsat.com. 31 October 2020. Retrieved 1 November 2020.

- ↑ "Iran Is Pivoting to Bitcoin". vice.com. 3 November 2020. Retrieved 10 November 2020.

- ↑ "Iran Has a Bitcoin Strategy to Beat Trump". foreignpolicy.com. 24 January 2020. Retrieved 10 November 2020.

- ↑ "Customer Advisory: Use Caution When Buying Digital Coins or Tokens" (PDF). U.S.Commodity Futures Trading Commission. Archived (PDF) from the original on 17 July 2018. Retrieved 17 July 2018.

- ↑ "Investor Alert: Bitcoin and Other Virtual Currency-related Investments". Investor.gov. U.S. Securities and Exchange Commission. 7 May 2014. Archived from the original on 30 June 2018. Retrieved 17 July 2018.

- ↑ "Ponzi schemes Using virtual Currencies" (PDF). sec.gov. U.S. Securities and Exchange Commission. Archived (PDF) from the original on 16 June 2018. Retrieved 17 July 2018.

- ↑ "Warning to consumers on virtual currencies" (PDF). European Banking Authority. 12 December 2013. Archived from the original (PDF) on 28 December 2013. Retrieved 23 December 2013.

- ↑ "Investor Alerts Don't Fall for Cryptocurrency-Related Stock Scams". FINRA.org. Financial Industry Regulatory Authority. 21 December 2017. Archived from the original on 1 July 2018. Retrieved 23 July 2018.

- ↑ "Informed Investor Advisory: Cryptocurrencies". North American Securities Administrators Association. April 2018. Archived from the original on 23 July 2018. Retrieved 23 July 2018.

- ↑ Dean, James (25 May 2018). "Bitcoin investigation to focus on British traders, US officials examine manipulation of cryptocurrency prices". The Times. Archived from the original on 25 May 2018. Retrieved 25 May 2018.

- ↑ Cornish, Chloe (24 May 2018). "Bitcoin slips again on reports of US DoJ investigation". Financial Times. Archived from the original on 24 May 2018. Retrieved 24 May 2018.

- ↑ Robinson, Matt; Schoenberg, Tom (24 May 2018). "U.S. Launches Criminal Probe into Bitcoin Price Manipulation". Bloomberg. Archived from the original on 24 May 2018. Retrieved 24 May 2018.

- ↑ McCoy, Kevin (24 May 2018). "Bitcoin value gyrates amid report of Department of Justice manipulation investigation". USA Today. Archived from the original on 24 May 2018. Retrieved 25 May 2018.

- ↑ Rubin, Gabriel T.; Michaels, Dave; Osipovich, Alexander (8 June 2018). "U.S. regulators demand trading data from bitcoin exchanges in manipulation probe". MarketWatch. Archived from the original on 8 June 2018. Retrieved 9 June 2018. Note:this is a short open access version of a Wall Street Journal article

- ↑ Rubin, Gabriel T.; Michaels, Dave; Osipovich, Alexander (8 June 2018). "U.S. regulators demand trading data from bitcoin exchanges in manipulation probe". The Wall Street Journal. Archived from the original on 8 June 2018. Retrieved 9 June 2018. (paywalled)

- ↑ Fung, Brian (21 May 2018). "State regulators unveil nationwide crackdown on suspicious cryptocurrency investment schemes". The Washington Post. Archived from the original on 27 May 2018. Retrieved 27 May 2018.

- ↑ Gandal, Neil; Hamrick, J.T.; Moore, Tyler; Oberman, Tali (May 2018). "Price manipulation in the Bitcoin ecosystem". Journal of Monetary Economics. 95: 86–96. doi:10.1016/j.jmoneco.2017.12.004. S2CID 26358036.

- ↑ Lee, Tim (12 December 2017). "A brief history of Bitcoin hacks and frauds". Ars Technica. Archived from the original on 28 May 2018. Retrieved 27 May 2018.

- ↑ Griffin, John M.; Shams, Amin (13 June 2018). "Is Bitcoin Really Un-Tethered?". Social Science Research Network. SSRN 3195066.

- ↑ Popper, Nathaniel (13 June 2018). "Bitcoin's Price Was Artificially Inflated Last Year, Researchers Say". The New York Times. Archived from the original on 13 June 2018. Retrieved 13 June 2018.

- ↑ Shaban, Hamza (14 June 2018). "Bitcoin's astronomical rise last year was buoyed by market manipulation, researchers say". The Washington Post. Archived from the original on 15 June 2018. Retrieved 14 June 2018.

- ↑ 95.0 95.1 Janda, Michael (18 June 2018). "Cryptocurrencies like bitcoin cannot replace money, says Bank for International Settlements". ABC (Australia). Archived from the original on 18 June 2018. Retrieved 18 June 2018.

- ↑ Hyun Song Shin (June 2018). "Chapter V. Cryptocurrencies: looking beyond the hype" (PDF). BIS 2018 Annual Economic Report. Bank for International Settlements. Archived (PDF) from the original on 18 June 2018. Retrieved 19 June 2018.

Put in the simplest terms, the quest for decentralised trust has quickly become an environmental disaster.

- ↑ Hiltzik, Michael (18 June 2018). "Is this scathing report the death knell for bitcoin?". Los Angeles Times. Archived from the original on 18 June 2018. Retrieved 19 June 2018.

- ↑ Velde, François (December 2013). "Bitcoin: A primer" (PDF). Chicago Fed letter. Federal Reserve Bank of Chicago. p. 4. Archived (PDF) from the original on 26 October 2014. Retrieved 3 September 2016.

- ↑ Wile, Rob (6 April 2014). "St. Louis Fed Economist: Bitcoin Could Be A Good Threat To Central Banks". businessinsider.com. Business Insider. Archived from the original on 24 September 2015. Retrieved 16 April 2014.

- ↑ Andolfatto, David (24 December 2013). "In gold we trust?". MacroMania. David Andolfatto. Archived from the original on 12 April 2017. Retrieved 17 April 2014.

Also, note that I am not against gold or bitcoin (or whatever) as a currency. In fact, I think that the threat that they pose as alternate currency can serve as a useful check on a central bank.

- ↑ Costelloe, Kevin (29 November 2017). "Bitcoin 'Ought to Be Outlawed,' Nobel Prize Winner Stiglitz Says". Bloomberg. Archived from the original on 12 June 2018. Retrieved 5 June 2018.

It doesn't serve any socially useful function.

- ↑ "Economics Nobel prize winner, Richard Thaler: "The market that looks most like a bubble to me is Bitcoin and its brethren"". ECO Portuguese Economy. 22 January 2018. Archived from the original on 12 June 2018. Retrieved 7 June 2018.

- ↑ 103.0 103.1 Wolff-Mann, Ethan (27 April 2018). "'Only good for drug dealers': More Nobel prize winners snub bitcoin". Yahoo Finance. Archived from the original on 12 June 2018. Retrieved 7 June 2018.

- ↑ "Bitcoin biggest bubble in history, says economist who predicted 2008 crash". 2 February 2018. Archived from the original on 12 June 2018.

- ↑ Braue, David (11 March 2014). "Bitcoin confidence game is a Ponzi scheme for the 21st century". ZDNet. Archived from the original on 6 October 2016. Retrieved 5 October 2016.

- ↑ Clinch, Matt (10 March 2014). "Roubini launches stinging attack on bitcoin". CNBC. Archived from the original on 6 October 2014. Retrieved 2 July 2014.

- ↑ "This Billionaire Just Called Bitcoin a 'Pyramid Scheme'". Archived from the original on 24 September 2017. Retrieved 23 September 2017.

- ↑ Ott Ummelas & Milda Seputyte (31 January 2014). "Bitcoin 'Ponzi' Concern Sparks Warning From Estonia Bank". bloomberg.com. Bloomberg. Archived from the original on 29 March 2014. Retrieved 1 April 2014.

- ↑ Posner, Eric (11 April 2013). "Fool's Gold: Bitcoin is a Ponzi scheme—the Internet's favorite currency will collapse". Slate. Archived from the original on 26 March 2014. Retrieved 1 April 2014.

- ↑ Kaushik Basu (July 2014). "Ponzis: The Science and Mystique of a Class of Financial Frauds" (PDF). World Bank Group. Archived (PDF) from the original on 31 October 2014. Retrieved 30 October 2014.

- ↑ "Federal Council report on virtual currencies in response to the Schwaab (13.3687) and Weibel (13.4070) postulates" (PDF). Federal Council (Switzerland). Swiss Confederation. 25 June 2014. Archived (PDF) from the original on 5 December 2014. Retrieved 28 November 2014.

- ↑ Mooney, Chris; Mufson, Steven (19 December 2017). "Why the bitcoin craze is using up so much energy". The Washington Post. Archived from the original on 9 January 2018. Retrieved 11 January 2018.

several experts told The Washington Post that bitcoin probably uses as much as 1 to 4 gigawatts, or billion watts, of electricity, roughly the output of one to three nuclear reactors.

- ↑ 113.0 113.1 Roberts, Paul (9 March 2018). "This Is What Happens When Bitcoin Miners Take Over Your Town - Eastern Washington had cheap power and tons of space. Then the suitcases of cash started arriving". Politico. Archived from the original on 9 March 2018. Retrieved 16 March 2018.

- ↑ de Vries, Alex (May 2018). "Bitcoin's Growing Energy Problem". Joule. 2 (5): 801–805. doi:10.1016/j.joule.2018.04.016.

- ↑ 115.0 115.1 Köhler, Susanne; Pizzol, Massimo (20 November 2019). "Life Cycle Assessment of Bitcoin Mining". Environmental Science & Technology. 53 (23): 13598–13606. Bibcode:2019EnST...5313598K. doi:10.1021/acs.est.9b05687. PMID 31746188.

- ↑ Baraniuk, Chris (3 July 2019). "Bitcoin's global energy use 'equals Switzerland'". BBC News. Archived from the original on 16 January 2020. Retrieved 2 February 2020.

- ↑ "How bad is Bitcoin for the environment really?". Independent. 12 February 2021. Retrieved 15 February 2021.

requires nearly as much energy as the entire country of Argentina

- ↑ O'Brien, Matt (13 June 2015). "The scam called Bitcoin". Daily Herald. Archived from the original on 16 June 2015. Retrieved 20 September 2016.

- ↑ Potenza, Alessandra (21 December 2017). "Can renewable power offset bitcoin's massive energy demands?". TheVerge News. Archived from the original on 12 January 2018. Retrieved 12 January 2018.

- ↑ Lampert, Allison (12 January 2018). "Chinese bitcoin miners eye sites in energy-rich Canada". Reuters. Archived from the original on 14 January 2018. Retrieved 14 January 2018.

- ↑ "Bitcoin is literally ruining the earth, claim experts". The Independent. 6 December 2017. Archived from the original on 19 January 2018. Retrieved 23 January 2018.

- ↑ "The Hard Math Behind Bitcoin's Global Warming Problem". WIRED. 15 December 2017. Archived from the original on 21 January 2018. Retrieved 23 January 2018.

- ↑ 123.0 123.1 Ponciano, Jonathan (18 April 2021). "Crypto Flash Crash Wiped Out $300 Billion In Less Than 24 Hours, Spurring Massive Bitcoin Liquidations". Forbes. Retrieved 24 April 2021.

- ↑ Murtaugh, Dan (9 February 2021). "The Possible Xinjiang Coal Link in Tesla's Bitcoin Binge". Bloomberg.com. Retrieved 24 April 2021.

- ↑ 125.0 125.1 Tully, Shawn (20 April 2021). "Commentary: How much Bitcoin comes from dirty coal? A flooded mine in China just spotlighted the issue". Fortune. Retrieved 23 April 2021.

- ↑ Chant, Tim De (10 May 2021). "Private-equity firm revives zombie fossil-fuel power plant to mine bitcoin". Ars Technica. Retrieved 10 May 2021.

- ↑ Hern, Alex (17 January 2018). "Bitcoin's energy usage is huge – we can't afford to ignore it". The Guardian. Archived from the original on 23 January 2018. Retrieved 18 September 2019.

- ↑ Ethan, Lou (17 January 2019). "Bitcoin as big oil: the next big environmental fight?". The Guardian. Archived from the original on 29 August 2019. Retrieved 18 September 2019.

- ↑ Foteinis, Spyros (2018). "Bitcoin's alarming carbon footprint". Nature. 554 (7691): 169. Bibcode:2018Natur.554..169F. doi:10.1038/d41586-018-01625-x.

- ↑ Krause, Max J.; Tolaymat, Thabet (2018). "Quantification of energy and carbon costs for mining cryptocurrencies". Nature Sustainability. 1 (11): 711–718. doi:10.1038/s41893-018-0152-7. S2CID 169170289.

- ↑ 131.0 131.1 Mora, Camilo; et al. (2018). "Bitcoin emissions alone could push global warming above 2°C". Nature Climate Change. 8 (11): 931–933. Bibcode:2018NatCC...8..931M. doi:10.1038/s41558-018-0321-8. S2CID 91491182.

- ↑ 132.0 132.1 Stoll, Christian; Klaaßen, Lena; Gallersdörfer, Ulrich (2019). "The Carbon Footprint of Bitcoin". Joule. 3 (7): 1647–1661. doi:10.1016/j.joule.2019.05.012.

- ↑ Masanet, Eric; et al. (2019). "Implausible projections overestimate near-term Bitcoin CO

2 emissions". Nature Climate Change. 9 (9): 653–654. Bibcode:2019NatCC...9..653M. doi:10.1038/s41558-019-0535-4. hdl:2066/207817. OSTI 1561950. - ↑ Dittmar, Lars; Praktiknjo, Aaron (2019). "Could Bitcoin emissions push global warming above 2°C?". Nature Climate Change. 9 (9): 656–657. Bibcode:2019NatCC...9..656D. doi:10.1038/s41558-019-0534-5.

- ↑ Houy, Nicolas (2019). "Rational mining limits Bitcoin emissions". Nature Climate Change. 9 (9): 655. Bibcode:2019NatCC...9..655H. doi:10.1038/s41558-019-0533-6.

- ↑ Kamiya, George. "Commentary: Bitcoin energy use - mined the gap". iea.org. Archived from the original on 3 March 2020. Retrieved 5 December 2019.

- ↑ Lavin, Tim (8 August 2013). "The SEC Shows Why Bitcoin Is Doomed". bloomberg.com. Bloomberg LP. Archived from the original on 25 March 2014. Retrieved 20 October 2013.

- ↑ Lee, Timothy B. (21 November 2013). "Here's how Bitcoin charmed Washington". The Washington Post. Archived from the original on 1 January 2017. Retrieved 10 October 2016.

- ↑ Popper, Nathaniel (13 July 2018). "How Russian Spies Hid Behind Bitcoin in Hacking Campaign". NYT. Archived from the original on 14 July 2018. Retrieved 14 July 2018.

- ↑ Ehrlich, Steven. "Janet Yellen, Bitcoin And Crypto Fearmongers Get Pushback From Former CIA Director". Forbes.

- ↑ Ball, James (22 March 2013). "Silk Road: the online drug marketplace that officials seem powerless to stop". theguardian.com. Guardian News and Media Limited. Archived from the original on 12 October 2013. Retrieved 20 October 2013.

- ↑ Montag, Ali (9 July 2018). "Nobel-winning economist: Authorities will bring down 'hammer' on bitcoin". CNBC. Archived from the original on 11 July 2018. Retrieved 11 July 2018.

- ↑ Newlands, Chris (9 July 2018). "Stiglitz, Roubini and Rogoff lead joint attack on bitcoin". Financial News. Archived from the original on 11 July 2018. Retrieved 11 July 2018.

- ↑ Foley, Sean; Karlsen, Jonathan R.; Putniņš, Tālis J. (19 February 2018). "Sex, drugs, and bitcoin: How much illegal activity is financed through cryptocurrencies?". University of Oxford Faculty of Law. Oxford Business Law Blog. Archived from the original on 10 June 2018. Retrieved 11 June 2018.

- ↑ Foley, Sean; Karlsen, Jonathan R.; Putniņš, Tālis J. (30 January 2018). "Sex, Drugs, and Bitcoin: How Much Illegal Activity Is Financed Through Cryptocurrencies?". Social Science Research Network. SSRN 3102645.

- ↑ Antonopoulos, Andreas (2017). "3". Mastering Bitcoin: Programming the Open Blockchain (2nd ed.). O'Reilly Media. ISBN 978-1491954386.

Bitcoin Core is the reference implementation of the bitcoin system, meaning that it is the authoritative reference on how each part of the technology should be implemented. Bitcoin Core implements all aspects of bitcoin, including wallets, a transaction and block validation engine, and a full network node in the peer-to-peer bitcoin network.

- ↑ "Bitcoin Core version 0.9.0 released". Bitcoin Core. 19 March 2014. Retrieved 21 October 2018.

- ↑ 148.0 148.1 148.2 Antonopoulos, Andreas M. (2014). Mastering Bitcoin: Unlocking Digital Cryptocurrencies. O'Reilly Media, Inc. pp. 31–32. ISBN 978-1491902646. Retrieved 6 November 2016.

- ↑ "MIT Announces $900,000 Bitcoin Developer Fund". Inc. 29 March 2016. Retrieved 21 October 2018.

- ↑ 150.0 150.1 "About". Bitcoin Core. Retrieved 21 October 2018.

- ↑ "Bitcoin Developer Examples". Bitcoin. Retrieved 21 October 2018.

- ↑ "checkpoints.cpp". Repository source code. GitHub, Inc. Retrieved 13 November 2016.

- ↑ "bitcoin/chainparams.cpp". GitHub. Retrieved 21 October 2018.

- ↑ Mike Orcutt (19 May 2015). "Leaderless Bitcoin Struggles to Make Its Most Crucial Decision". MIT Technology Review. Retrieved 15 November 2016.

- ↑ "Alert System Retirement". Bitcoin Project. 1 November 2016. Retrieved 16 November 2016.

- ↑ Antonopoulos, Andreas (29 May 2013). "Bitcoin is a money platform with many APIs". Radar. O'Reilly. Retrieved 19 November 2016.

- ↑ "Bitcoin Core devtools README - Create and verify timestamps of merge commits". GitHub. Retrieved 5 May 2018.

- ↑ 158.0 158.1 Preukschat, Alex; Josep Busquet (2015). Bitcoin: The Hunt of Satoshi Nakamoto. Europe Comics. p. 87. ISBN 9791032800201. Retrieved 16 November 2016.

- ↑ Maria Bustillos (25 August 2015). "Inside the Fight Over Bitcoin's Future". New Yorker. Retrieved 29 June 2020.

- ↑ Shin, Laura. "Bitcoin And Taxes: If Not HODLing, Consider Donating". Forbes. Archived from the original on 22 December 2017. Retrieved 22 December 2017.

- ↑ Kaminska, Izabella (22 December 2017). "The HODL". Financial Times. Retrieved 21 November 2018.

- ↑ Montag, Ali (26 August 2018). "'HODL,' 'whale' and 5 other cryptocurrency slang terms explained". CNBC. Retrieved 12 November 2020.

- ↑ Wong, Joon Ian. "Buy and hodl, just don't get #rekt: The slang that gets you taken seriously as a bitcoin trader". Quartz. Archived from the original on 22 December 2017. Retrieved 22 December 2017.

- ↑ Akhtar, Tanzeel (22 December 2017). "As Bitcoin plunges, cryptocurrency fans chant 'HODL' for comfort". TheStreet. Archived from the original on 23 December 2017. Retrieved 22 December 2017.

- ↑ Hajric, Vildana (19 November 2020). "All the Bitcoin Lingo You Need to Know as Crypto Heats Up". Bloomberg. Retrieved 1 December 2020.

- ↑ Stross, Charles (2013). Neptune's Brood (First ed.). New York: Penguin Group USA. ISBN 978-0-425-25677-0.

It's theft-proof too – for each bitcoin is cryptographically signed by the mind of its owner.

- ↑ "Crib Sheet: Neptune's Brood – Charlie's Diary". www.antipope.org. Archived from the original on 14 June 2017. Retrieved 5 December 2017.

I wrote Neptune's Brood in 2011. Bitcoin was obscure back then, and I figured had just enough name recognition to be a useful term for an interstellar currency: it'd clue people in that it was a networked digital currency.

- ↑ Kenigsberg, Ben (2 October 2014). "Financial Wild West". The New York Times. Archived from the original on 18 May 2015. Retrieved 8 May 2015.

- ↑ Michel, Lincoln (16 December 2017). "What the Hell Is Bitcoin? Let This Documentary on Netflix Explain". GQ. Archived from the original on 18 November 2018. Retrieved 10 October 2018.

- ↑ "Introducing Ledger, the First Bitcoin-Only Academic Journal". Motherboard. Archived from the original on 10 January 2017.

- ↑ "Editorial Policies". ledgerjournal.org. Archived from the original on 23 December 2016. Retrieved 10 January 2017.

- ↑ "How to Write and Format an Article for Ledger" (PDF). Ledger. 2015. doi:10.5195/LEDGER.2015.1 (inactive 31 May 2021). Archived (PDF) from the original on 22 September 2015.

{{cite journal}}: CS1 maint: DOI inactive as of May 2021 (link)